概要

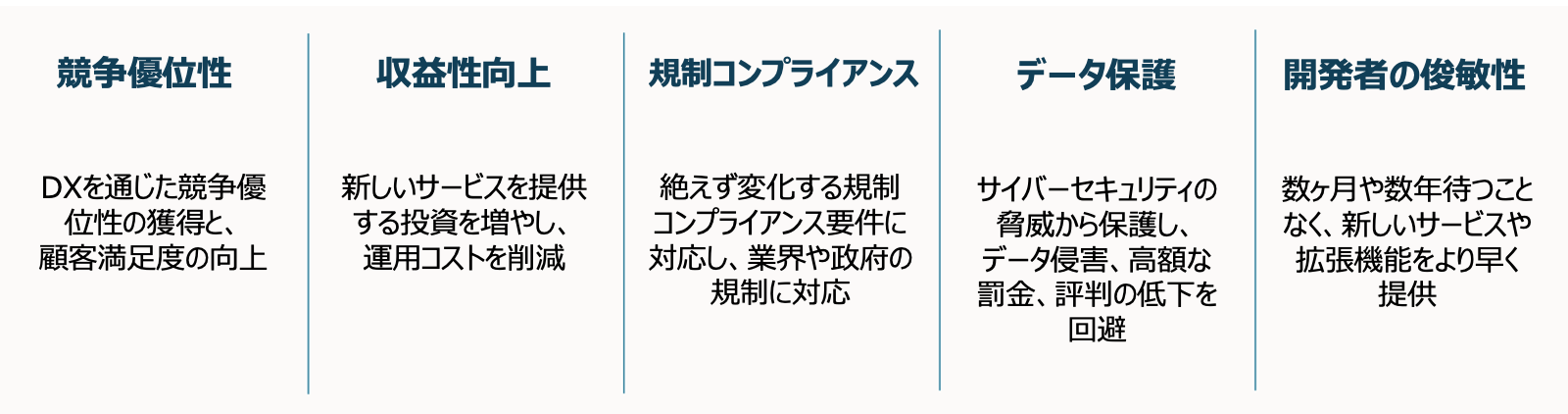

MySQL Enterprise Editionは、700以上の金融サービス企業のデジタルトランスフォーメーション(DX)を支援し、競争力強化に貢献してきました。その優れたパフォーマンスとスケーラビリティは、最も厳しい要件のアプリケーションにも対応できます。また、貴重なデータを保護し、データ侵害のリスクを低減し、規制要件に準拠することができます。さらに、オープンソースならではの柔軟性により、オンプレミス、クラウド、ハイブリッド環境など、あらゆる環境での導入が可能です。

MySQL Enterprise Editionの優位性

金融業界におけるMySQLのお客様

金融サービス向けMySQLリファレンス・アーキテクチャ

MySQLは、金融サービスで使用されるさまざまなアプリケーションに最適です。一般的な使用例には次のようなものがあります。

- コア・バンキング:MySQL を利用して、コア・バンキング業務の柔軟性と効率性を高めることができます。

- オンライン・バンキング:MySQLを利用して、Webサイトやモバイル・アプリによるセルフサービス・オンライン・バンキングを実現し、顧客満足度を向上させます。

- 投資銀行業務: MySQLは、引受(資本調達)およびM&A(合併・買収)アドバイザリーサービスを可能にすることで、政府、企業、機関投資家を支援します。

- ブロックチェーン:MySQLを活用して銀行主導のブロックチェーン・プラットフォームをサポートし、デジタル資産のシームレスな交換を促進するダイナミックな金融エコシステムを構築します。

- 外国為替:MySQLを活用して、外国為替(FX)とも呼ばれる国際通貨の売買を自動化し、業務を効率化します。

- 決済ゲートウェイ:MySQL は、グローバルな決済の承認と処理に対応するパフォーマンスとスケーラビリティを提供します。

- 証券取引:MySQL を使用して、1 日あたり数十億件の注文を処理し、継続的に成長を続ける取引プラットフォームのパフォーマンスとスケーラビリティの要件を満たします。

- KYC(本人確認) :MySQL を利用することで、金融機関は規制要件を満たし、顧客との関係を改善し、金融犯罪を特定して防止するための費用対効果の高い手段を提供することができます。

- リスク管理:MySQLは、リスクを特定、評価、コントロールする継続的なプロセスを管理し、安定性と持続性を確保します。

- 不正検出:MySQLは、不正な取引や活動を特定するための高性能なデータ処理を提供します。

- 金融犯罪とコンプライアンス(FCC):MySQLを利用して、マネーロンダリング、不正行為、サイバー脅威への対策を強化し、ビジネス、顧客、評判を保護します。

その他のリソース

- ホワイトペーパー:金融サービス向けMySQL Enterprise Edition

- WePay、MySQL Enterprise Editionで決済プラットフォームを強化

- ボンベイ証券取引所 BSE、MySQL Enterprise Editionの性能拡張性を活用し取引量900%増加に対応

- KB国民銀行、MySQL Enterprise Editionで顧客ロイヤルティを向上

- アメリカ・ファースト・クレジット・ユニオン、MySQL Enterprise Editionで会員体験を向上

- RBL銀行、MySQL Enterprise Editionでセキュリティ、コンプライアンス、運用効率を強化