Overview

MySQL Enterprise Edition has enabled over 700 financial services organizations to gain a competitive advantage through digital transformation initiatives. MySQL has proven performance and scalability for the most demanding applications. It allows them to protect their valuable data, reduce the risk of data breaches, and comply with regulatory requirements. Additionally, its open-source nature provides these entities with the flexibility to deploy services on-premises, in the cloud, or in hybrid environments.

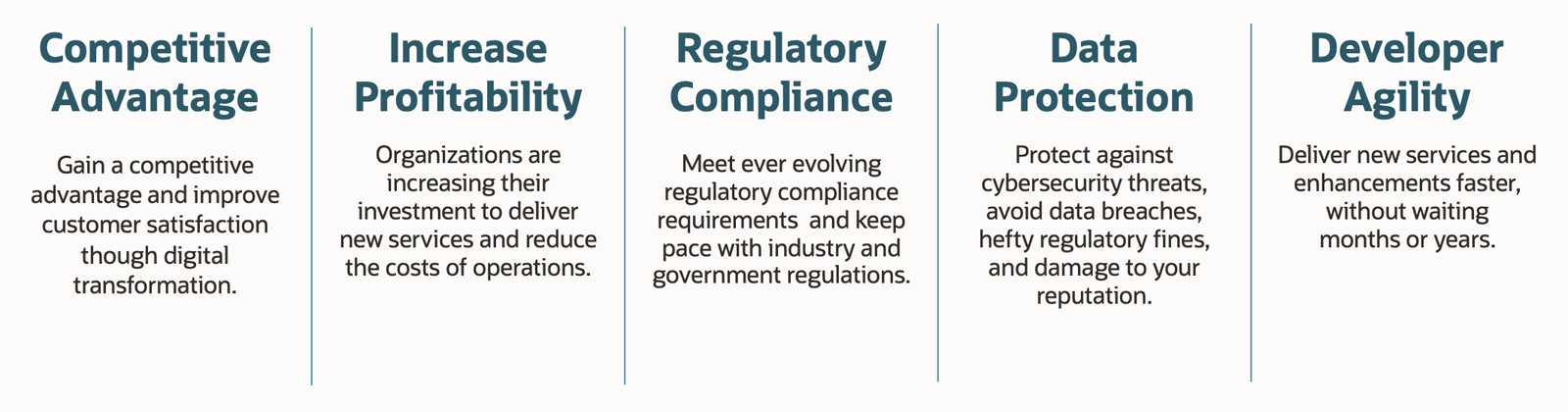

Benefits

MySQL Customers in Financial Services

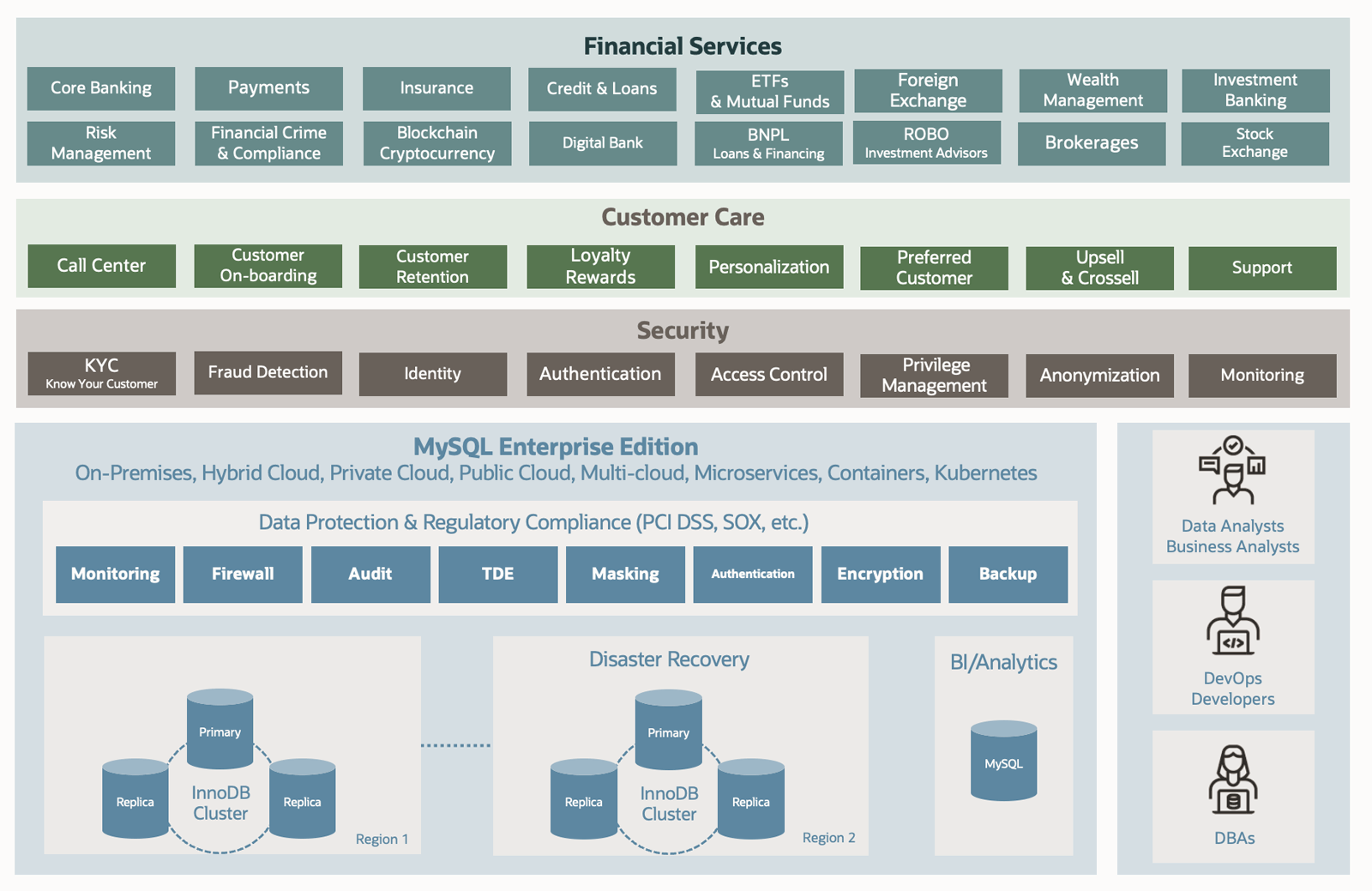

MySQL Reference Architecture for Financial Services

MySQL is ideally suited for a variety of applications used in Financial Services. Some of the popular use cases include:

- Core Banking: Bring more flexibility and efficiency to your core banking operations with MySQL.

- Online Banking: Improve customer satisfaction by using MySQL to enable self-service online banking via a website and mobile app.

- Investment Banking: MySQL helps governments, corporations, and institutions by enabling underwriting (capital raising) and mergers and acquisitions (M&A) advisory services.

- Blockchain: Leverage MySQL to support bank-led blockchain platforms, creating dynamic financial ecosystems that facilitate the seamless exchange of digital assets.

- Foreign Exchange: Streamline operations by using MySQL to automate the buying and selling of international currencies, also known as foreign exchange (FX).

- Payment Gateways: MySQL delivers the performance and scalability for authorizing and processing payments globally.

- Stock Exchange: Use MySQL to meet the performance and scalability requirements of trading platforms with billions of orders per day and continuous growth.

- KYC: MySQL enables financial institutions to meet regulatory requirements, improve customer relationships, and provides cost-effective measures to identify and prevent financial crimes.

- Risk Management: MySQL manages the continuous process of identifying, assessing, and controlling risks to ensure stability and sustainability.

- Fraud Detection: MySQL provides the high performance data processing to identify fraudulent transactions and activities.

- Financial Crime & Compliance (FCC): Use MySQL to strengthen your safeguards against money laundering, fraud, and cyber threats—shielding your business, your customers, and your reputation.

Additional Resources

- White Paper: MySQL Enterprise Edition for Financial Services

- Mumbai Stock Exchange BSE Meets 900% Trading Growth by Scaling with MySQL Enterprise Edition

- KB Kookmin Bank improves customer loyalty with MySQL Enterprise Edition

- America First Credit Union Boosts Membership Experience with MySQL Enterprise Edition

- Lina One, South Korean insurance provider, boosts telemarketing efficiency with MySQL Enterprise Edition

- RBL Bank Boosts Security, Compliance and Operational Efficiency with MySQL Enterprise Edition